Bitcoin Ordinals: The Theory Behind Bitcoin NFTs

The simple theory, history, current state and pros and cons behind Bitcoin Ordinals

Today I'll try to explain, in simple terms, what Bitcoin Ordinals are. I’ll briefly review digital objects on Bitcoin history, share data insights to understand the current state better, and finally, add my takes on the pros and cons of this new development.

We have much to cover, so let’s start with some theory.

What Are Bitcoin Ordinals – The Theory

What made this whole thing possible was the introduction of the Ordinals theory by Casey Rodarmor, which introduced the concept of “inscribing” content in Satoshis.

Satoshis are the atomic - or minimum subdivision - of a Bitcoin. A Bitcoin can be reduced to 100,000,000 satoshis, but no further.

The most important aspect, in my opinion, is that no sidechains, tokens, or changes are required. It works right now.1

Ordinals’ theory is basically an accounting method.

They inherit features of Bitcoin like storing the actual content on the blockchain as long as it runs, instead of off-chain systems like IPFS.

You have to buy a space in the Bitcoin chain to store the files. Therefore these are very scarce (since the space to store them is very expensive).

Udi Wertheimer founder of TapRoot Wizards

History of Digital Objects and NFTs on Bitcoin

Although Ordinals are pretty unique for the reasons listed above, this isn’t the first time there was a proposal to bring digital objects (in different forms) to Bitcoin. Some examples are Colored Coin, Mastercoin, and Counterparty.

The Rare Pepes were minted on Counterparty; these culturally popular NFTs have survived the passing of time and are some of the most valuable digital objects to date.

Nevertheless, most of these projects failed as the community around Bitcoin focused on making Bitcoin the most effective digital currency and dodged distractions (such as digital objects) in their mission. Things might be different this time, as NFTs have shown fantastic potential and attracted many users over the past years.

If Bitcoin wants to be used globally, at a grand scale, how could it not be used to buy and sell digital objects? It feels like this should be a clear use case to cover.

Sean Moss-Pultz, Bitmark Co-Founder and CEO (creators of Autonomy.io and Feral File), shared that it is a clever move, but in his eyes, some pieces are missing to make it work.

What’s great about Bitcoin is how constraint it is and how tightly knit the community is around the idea of making a better money for the world. Of course, that’s a double edge sword if your goal is to experiment with things that are “store of value” like, but not money.

There is no good code-based way to produce what the Ethereum community calls “composability” because the scripting language was purposely limited for security and speed reasons.

Ordinals is just using standard parts of the bitcoin script.

The other thing is that, even though you can do it technically speaking on Bitcoin, you are missing the vibrant market and community around chains like Ethereum and Tezos.

It's a clever move. But similar things have been tried every two years since around 2014. Including the original Bitmark protocol.

What is an Ordinal Inscription?

Currently, it isn’t easy to find stats about actual sales, volumes, and floors. I’ve seen marketplaces popping up, but still trying to figure out which ones are legit.

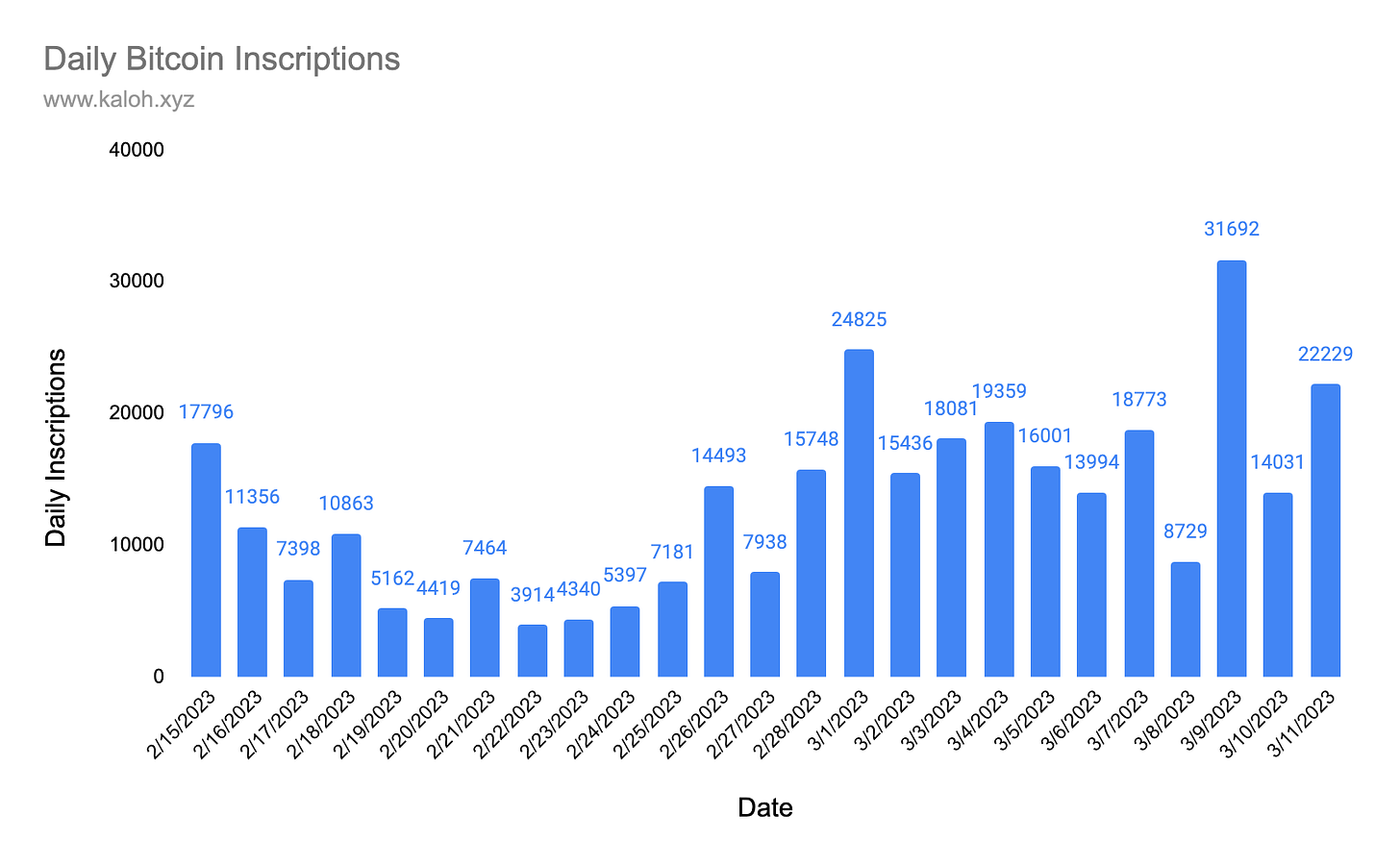

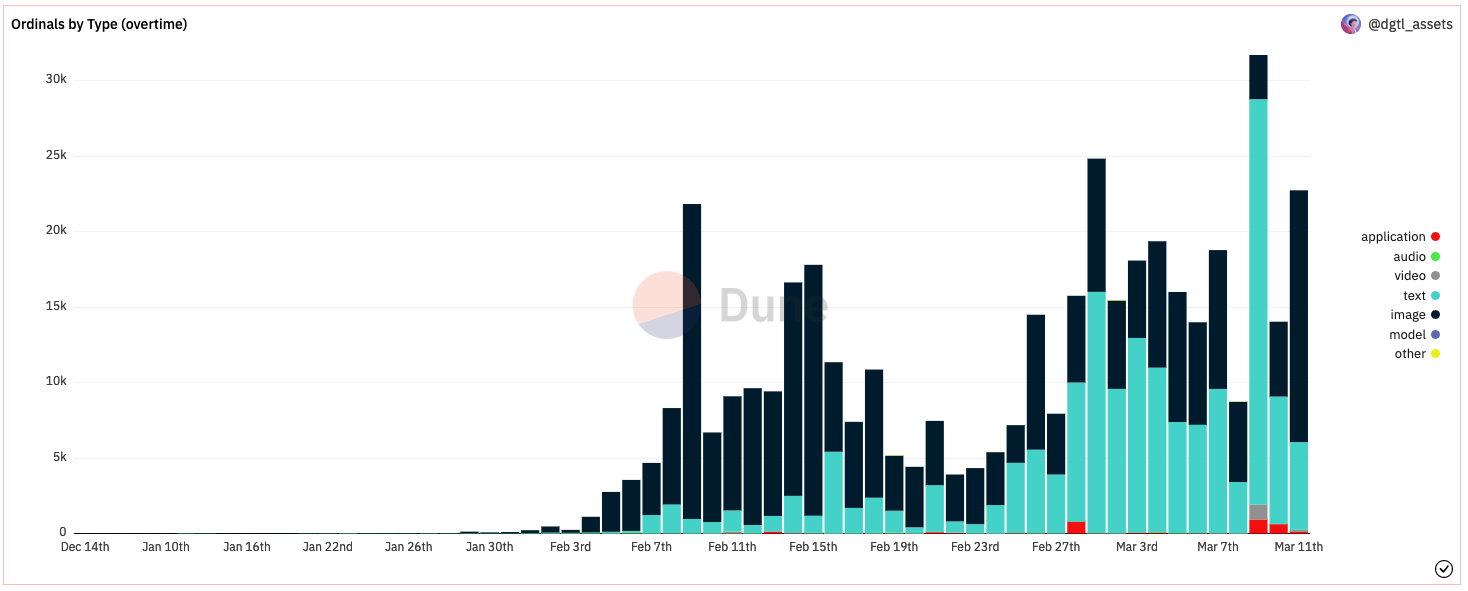

I found data in terms of inscriptions created and types2.

More creators are learning about Bitcoin Ordinals, which has produced a whopping 78 Bitcoin ($1.5M) in paid fees.

Yuga Labs Earns Over $16M with TwelveFold

The creators of the Bored Ape Yacht Club, among other popular NFTs, didn’t lose time to leave their mark on Bitcoin. Last week, they executed the first auction on Bitcoin for their generative onchain TwelveFold collection.

The whole process was very rudimentary, as bidders had to send their Bitcoins to a wallet, and in case they didn’t place a winning bet, Yuga committed to returning the Bitcoins after 24 hours.

It still isn't clear what the future of Oridnals might be, but this was undoubtedly a great start.

To close this issue, I would like to state the pros and cons of Bitcoin Ordinals.

Pros of Bitcoin Ordinals

Fully onchain assets, which should last as Bitcoin lasts. No risk of platforms or companies shutting down.

A new use case for Bitcoin that could draw masses to the NFT and digital objects space.

A new use case for Bitcoin millionaires to enter the game (those that haven’t done it).

Cons of Bitcoin Ordinals

Hard to innovate in terms of mechanics and use cases as the Bitcoin protocol standards must be maintained.

Inscribing is an expensive process, which will make these NFTs expensive by default.

It is hard to group Bitcoin Ordinals into collections, as this structure isn’t possible on Bitcoin. Collections are being grouped by off-chain mechanisms (e.g., Spreadsheets), which causes confusion and makes it easier to produce fakes.

As we all know, Bitcoin is a proof-of-work blockchain that requires vast resources. Although it is hard to calculate exact figures, it is clear that having content stored on satoshis will demand even more resources.

These are my current views, but they could change quickly as I learn more, projects emerge, and infrastructure and accessibility develop.

As always, interested in understanding your opinion…

Until next time,

- Kaloh

If you enjoyed this issue, consider subscribing to Kaloh’s Newsletter to receive my articles for free in your inbox. For the full experience, become a premium subscriber.

What you’ll get:

Receive premium and public posts, and access the full archive.

Access to my private Discord server with over 300 NFT enthusiasts.

Participate in monthly giveaways.

PD: If you liked my writing, feel free to click the ❤️ button on this post so more people can discover it on Substack 🙏

This was great Kaloh! Thanks

It was a very useful article.

I just started ordinals.

Also, how do I join your Discord?