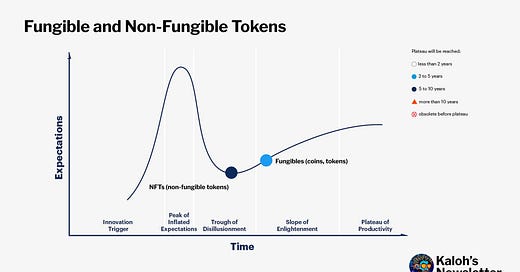

Hype Cycles: Non-Fungible Tokens vs. Fungible Tokens

There’s been a lot of talk about the rise of tokens and the fall of NFTs. In this piece, I share why I believe NFTs aren’t dead—they’re just getting started again.

Before we dive into this issue, I wanted to share something new I’ve been working on—Indexy. A new app designed to make tracking, investing, and learning about crypto markets easier and more effective.

Right now, keeping up with crypto feels outdated. With new sectors constantly emerging across different blockchains, tracking one coin at a time just doesn’t cut it anymore. We need better tools to follow trends, reduce risks, and get a clearer picture of the market.

Try out the Beta 👉 Indexy.xyz

Today, I want to tackle the topic of NFTs (Non-Fungible Tokens) vs. Tokens, also called coins (fungibles). The appetite for NFTs is at an all-time low, and the "NFTs are dead" narrative keeps popping up. Multiple NFT marketplaces have shut down over the past year, with MakersPlace being the most recent casualty. Even successful NFT platforms like Foundation, Zora, fxhash, and SuperRare have shifted their strategies, moving away from the traditional NFT mint model in different ways.

Foundation introduced Rodeo, a new platform that moves away from scarcity by embracing an abundance model with editions, while still keeping its main marketplace running. Meanwhile, Zora went even further by introducing coins—1 billion tokens per creation—essentially moving away from NFTs altogether. Fxhash has outlined plans for an airdrop, in addition to the launch of $artist tokens (no clear release date at the time of this writing). And finally, SuperRare has invested heavily into tokens with their $RARE token and protocol improvements that use these tokens for different kinds of rewards (both for artists and collectors).

Although the top 1% of NFTs still sell for over five figures, and we occasionally see historical pieces go for seven figures, these cases are rare. The PFP (profile picture) meta is almost non-existent. The top projects that have survived are experimenting with new business models and distribution strategies, often moving away from NFTs. Instead, they’re exploring physical products, launching coins, or building new infrastructure. Pudgy Penguins is a prime example, with $Pengu, physical toys hitting major retail stores like Walmart and Target, and the launch of Abstract Chain.

So, while not much has been happening in the NFT space, Bitcoin has hit new all-time highs. The U.S. president launched a coin, showing massive support for crypto, and regulators have dropped lawsuits against some of the world's top crypto companies. Stablecoins have also gained clear adoption, with more people recognizing them as a more efficient way to handle money.

We've been in a bull market for over six months, and coins have been on fire. But NFTs? Not so much.

Wait a moment. We need to zoom out, because I think most of us (me included) have been guilty of recency bias when it comes to NFTs (art, collectibles, and everything in between). Things aren’t as bad as they sound for your JPEGs.

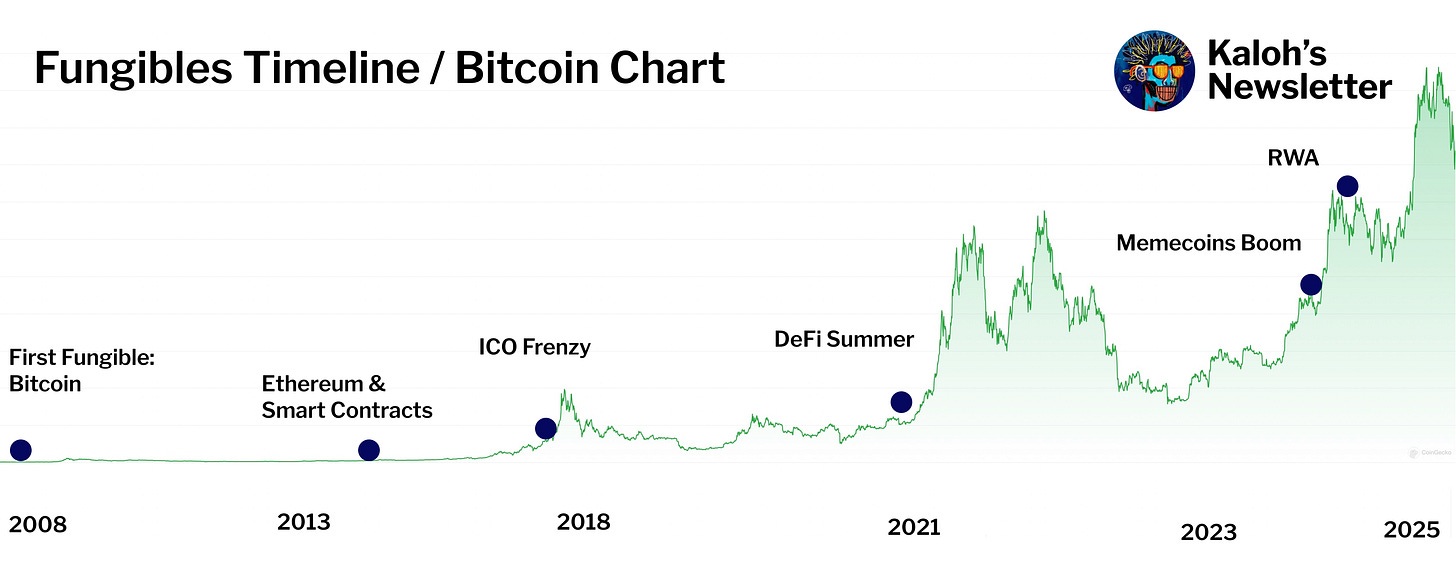

History of Fungibles

Fungible tokens have been around since the beginning of blockchain-powered cryptocurrencies, starting with Bitcoin (the first crypto coin).

Here is a timeline of relevant cryptocurrency events:

First fungible token: Bitcoin (2008).

Ethereum and the introduction of smart contracts (2015).

ICO frenzy (2017).

DeFi Summer (2020).

Memecoins boom (2024-2025).

Tokenized companies and real-world assets (RWA) (2024-?).

The new trend on the horizon is the tokenization of everything, a category called Real World Assets (RWA). Companies like Coinbase are leading the pack, showing intentions to tokenize their stock. In addition, apps like Robinhood have been exploring crypto heavily, and their CEO has discussed the idea of tokenized real estate as a possibility.

What’s interesting is that we can map all these events on the Bitcoin chart. We don’t really need to look elsewhere to track the history of fungibles and their traction over time. Their adoption curve is pretty close, if not exact, to Bitcoin’s price movements.

History of NFTs (Non-Fungibles)

Let’s now look at the same timeline for NFTs.