Are NFTs a Modern Tulip Mania?

My encounter with a "Right Click Saver" made me research tulips' history

The other day, while using the newest Substack feature — Notes — I stumbled across a “Right Click Saver” (or someone that doesn’t get NFTs), who argued they are a modern “Tulip Mania”. I wasn’t familiar with the tulips frenzy, so after researching for a bit, I found an exciting topic to write about… Somehow related to NFTs and blockchain art.

Consider subscribing to my newsletter to receive the latest trends, market insights, and an overview of the digital art world:

What is The Tulip Mania?

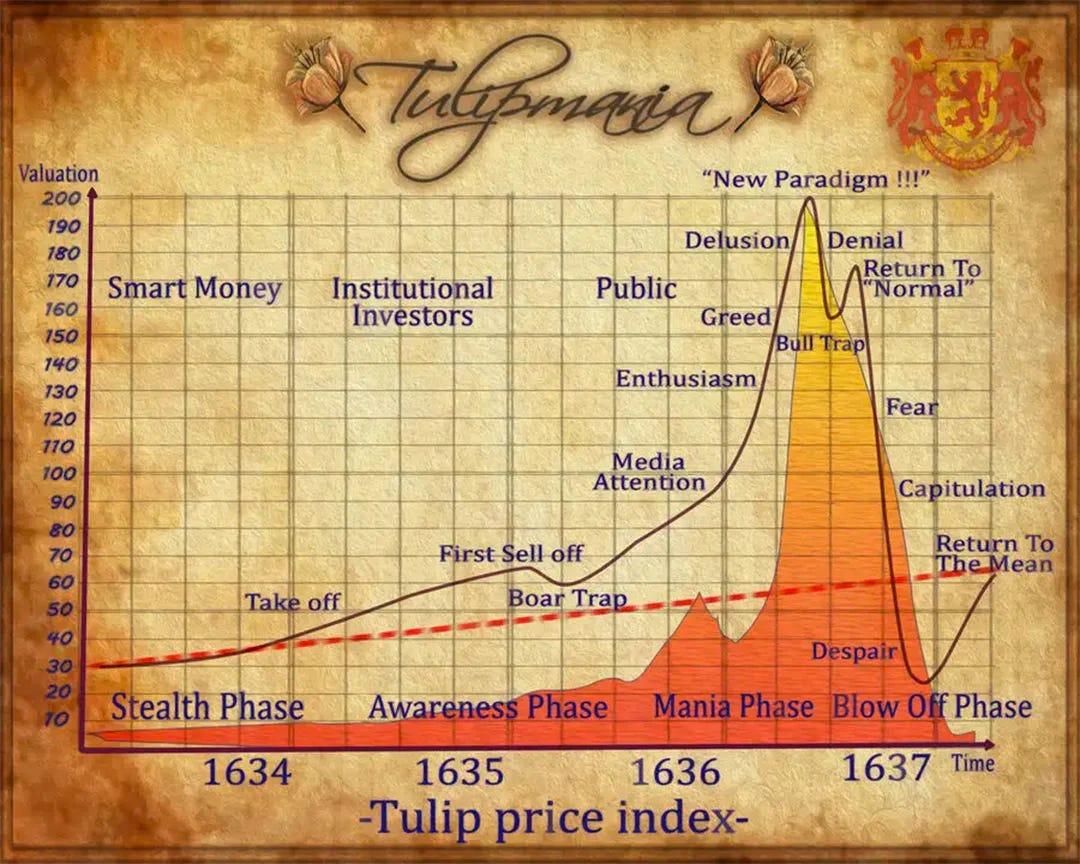

Tulip Mania was a speculative bubble that occurred in the Netherlands during the Dutch Golden Age in the 17th century. It is considered one of the first recorded economic bubbles in history.

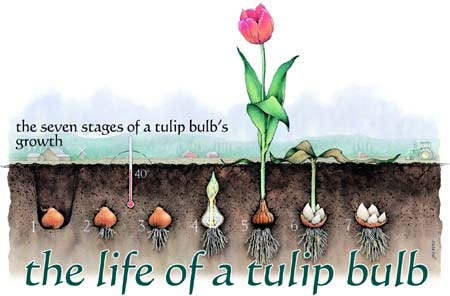

Tulip bulbs, introduced to the Netherlands from Turkey, became popular among the Dutch upper class in the early 17th century.

The demand for tulip bulbs soon grew to the point where they were traded on exchanges, with prices skyrocketing. At the bubble’s peak in 1637, some tulip bulbs were selling for more than 10 times the annual income of a skilled craftsman.

The obsession to possess tulip bulbs was so great that the ordinary industry of the country was neglected, and the population, even to its lowest dregs, embarked in the tulip trade. A single bulb of tulip cost as much as 4,000 to even 5,500 florins – which meant that the best of tulips cost more than $750,000 in today’s money.

By 1636, the demand went so high that regular marts for sale of tulips were established on the Stock Exchange of Amsterdam, and professional traders got in on the action. Everybody appeared to be minting money simply by possessing some of these rare bulbs. It seemed at the time that the price could only go up; that the rage for tulips would last forever.1

The Bubble Burst Shortly

Many investors who had purchased tulip bulbs on credit were left with huge debts, while others lost their entire fortunes. Some investors traded tulip bulbs multiple times in a single day, hoping to profit from price increases.

Sound familiar?

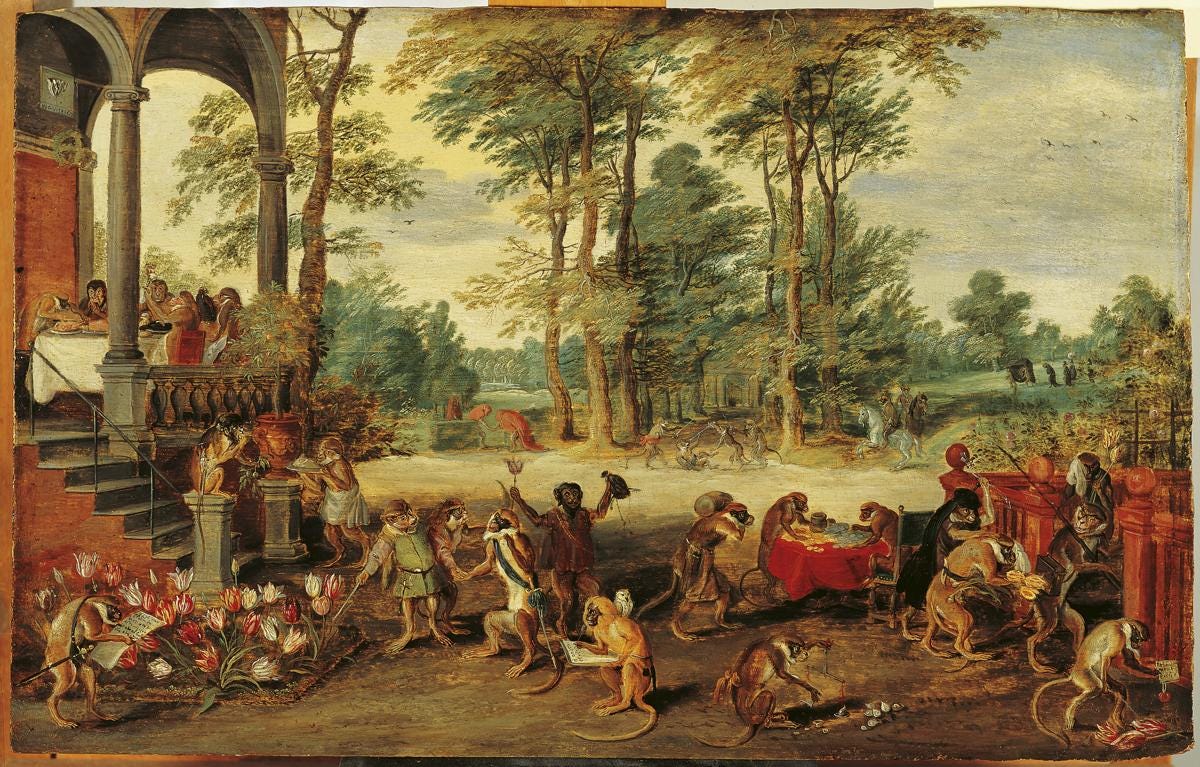

After these events, a tulip satire movement emerged...

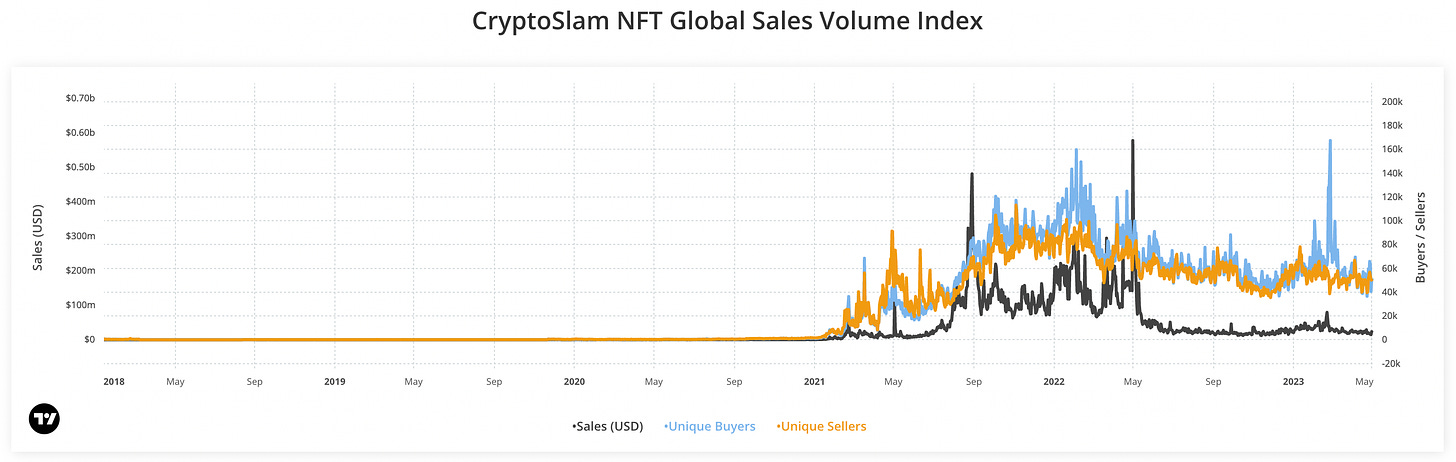

There are clear similarities to the NFT movement, especially during 2021 / 2022. But there are also evident differences...

What Is The Difference Between The Tulip Mania and NFTs?

Tulip Mania was driven in part by the novelty and scarcity of tulip bulbs, the social status associated with owning them, and the goal of making money — similar to the "NFT Mania". Nevertheless, NFTs and blockchain have profound benefits and innovations, not found in tulips...

First of all, comparing NFTs to tulips is like comparing apples to pears. NFTs are a technology that runs on the blockchain. An NFT can represent many kinds of items - memberships, assets in a game, art, or a virtual tulip — which makes them highly flexible, empowering a myriad of use cases. Tulips are just tulips (and they are high maintenance!).

If we narrow it down to digital art, there are multiple reasons why the combination of blockchain and NFTs are powerful and special:

Authenticity: verify the creator and the owner, in a few clicks.

Provenance: verify when it was created, all the transactions, previous owners, and value over time.

Empowering an open creator economy: it is easy and transparent to support digital artists.

For early adopters: The excitement of being part of a new and emerging market

Borderless: connecting creators and fans, from anywhere, anytime.

Uniqueness: New art forms, not possible before.

And the list goes on...

Coming back to the person arguing NFTs are a new form of Tulip Mania (which I’ve to thank for this article's inspiration), he/she mentioned they run on an “imaginary” and “fake” economy (crypto). Although I won’t expand on why crypto isn’t a fake economy, I need to mention that NFTs and blockchain aren’t necessarily tied to crypto. In fact, many marketplaces already support credit card purchasing and selling using your favorite currency.

Did you know the story about the Tulip Mania? Do you see similarities with the NFT market?

I would love to hear your thoughts...

Until next time,

- Kaloh

Consider subscribing to Kaloh’s Newsletter to receive my articles for free in your inbox. For the full experience, become a premium subscriber.

What you’ll get:

Receive premium and public posts, and access the full archive.

Access to my private Discord server with over 300 digital art enthusiasts.

Participate in monthly giveaways.

Myriad by Anna Ridler is an artwork where AI tulips grow related to BTC price, it's based around tulip mania. She's in my talk on AI and Image at CAS on 1 June. What a coincidence! http://annaridler.com/myriad-tulips

Nice post Kaloh :) I did know about the Dutch tulip mania, known about it for many years in fact. Pretty crazy. We humans haven't really changed, have we! I do see some similarities with crypto and NFTs (and GameStop and a lot of other stocks, especially during the pandemic), but it's not a direct or perfect comparison. For one thing, it was contained within one nation. Crypto, NFTs, and the stock market in general are global systems.

As for the "imaginary" economy concept... aren't all economies imaginary, in a sense? They do not occur in Nature; they are uniquely human constructs, imagined and developed by us. Take money. Yes, it started out as a physical thing (gold, seashells, cacao beans) and today we have a new form of money that is digital. Even "real" money translates into digital numbers in your traditional bank account. A society needs to believe in the value and power of money in order for it to be effectively real. Same with any other type of currency or transaction.