🔬 How to Successfully Invest in Generative Art on FxHash

Discover insights to smartly jump on the gen-art movement

Over the past month, I had a blast collecting generative art pieces on the FxHash Tezos platform. It feels like a new revolution, both artistically and economically, where creative coding evolves every day and is valued accordingly. Today, I’d like to share some advice that helped me increase my portfolio value by over 130%.

Consider subscribing to my newsletter to receive my articles directly in your inbox.

Rule number one should be to collect what you like. The problem is that art is subjective and what you like might not be liked by others. For that reason, you need a better system. This article is intended for those looking to follow a purely logical and “cold” method, rather than an art-driven one. By the way, I am working on another piece with a method to criticize generative art from a pure art perspective. Stay tuned if you are looking for generative art reviews.

Before we get started, you might want to read “💵 How to flip NFTs (for beginners)”. Many of those concepts still apply, but I’ve noticed some extra points specifically valuable for FxHash collections.

1. Avoid copy minters

Sounds easy, but it is not. Copy minters are scammers who copy others’ collections and release them as the original. I’ve minted one by mistake, and some friends also struggle with this. Like many other platforms, FxHash is struggling with this situation, but they have already built a community-driven system to flag copy minters, and it seems to be working. The best way to avoid falling into their traps is to verify the artist’s profile, review their Twitter connection, and be suspicious of low prices. Additional steps would be to verify the transaction history or even talk to other community members if something seems weird or out of place.

Artists: make sure all your profiles are connected and verified (!)

2. Mint!

Although you can find great deals in the secondary market, nothing will ever meet collecting a gem at its mint price. Sounds easy, but unfortunately, it is getting harder. Collectors are increasing, and talented artists sell their collections in minutes (which is excellent!). Also, there is no mint schedule, so you have to do your homework by following artists on their social media and be ready (and lucky) to get your transaction through.

One last advice would be to tick up your gas fees. If you are in a “minting war”, increasing your gas fee by a couple of bucks will put you ahead of other minters.

3. Analyse the artists’ community

Look out for true fans and collectors who are passionate about the art and the artists’ technique. Solid communities that genuinely collect NFTs will increase the success long term. People who purchase something because they like it will hold it and avoid selling it at all costs. This scenario will organically drive the collection's value up, as fewer pieces will be up for sale, therefore, less supply.

In the tweet below, you see how Chris Wallace, a popular and passionate collector, is trying to figure out which piece from Hevey’s Sequence he will frame…

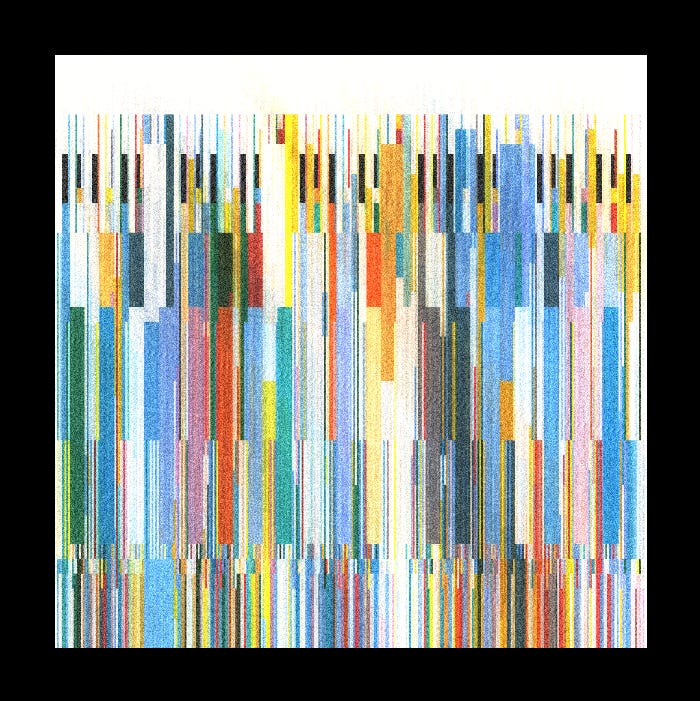

4. Research the artists’ background and training

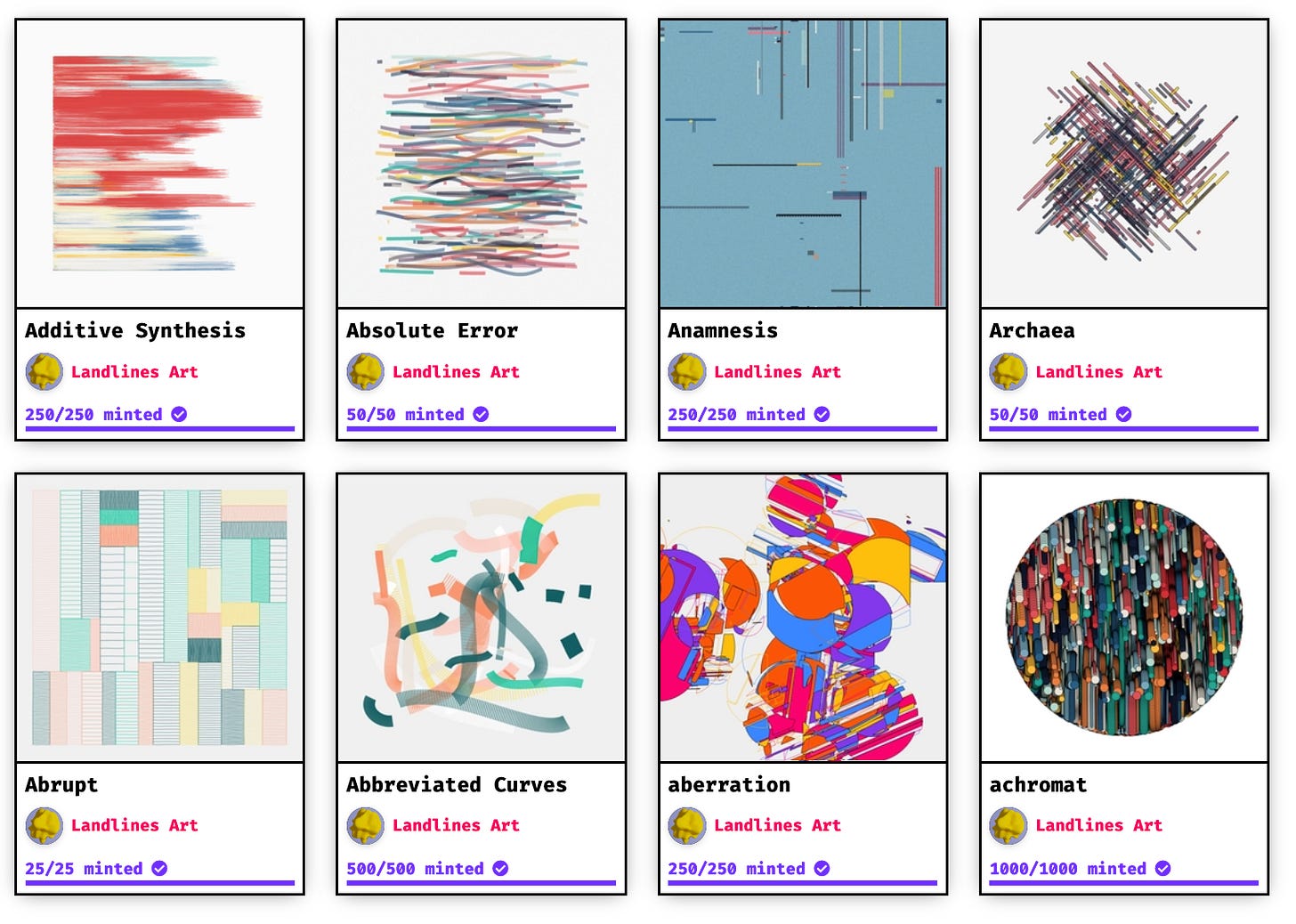

Creative coding and generative art require special skills that take time to develop. What makes this new type of art so particular is the barrier of entry for creators. Coding is not easy, and making an algorithm that produces beautiful pieces while maintaining diversity and complexity in the same collection is damn hard.

One way to evaluate collections is to look at the creator’s background. How long have they been coding? How long have they been involved in generative art? Did they work in software development, UI/UX design, data science, or AI?

Let’s take a look at Marcelo Soria-Rodriguez, the creator of contrapuntos. His Twitter account tells us that he runs a website/blog called i·illucid, specializing in strategy, thoughts, and inspiration for art, data, and AI. From this website, you can look at his professional background. He is an engineer with over 20 years of experience in various fields. He has founded multiple startups and communities centered around data analytics and worked many years for the multinational BBVA bank, holding executive positions related to innovation, data, and analytics. Wow!

You don’t always need to perform such a detailed check, and also, artists don’t need to have such a strong background as Mariano. Nevertheless, gathering as much information as possible will help you build a profile in your head and make better decisions.

5. How often is the artist minting?

Minting a new collection every day will not help the long-term success of artists due to the amount of supply. Good collections require time to be coded; each part of the algorithm must be perfect.

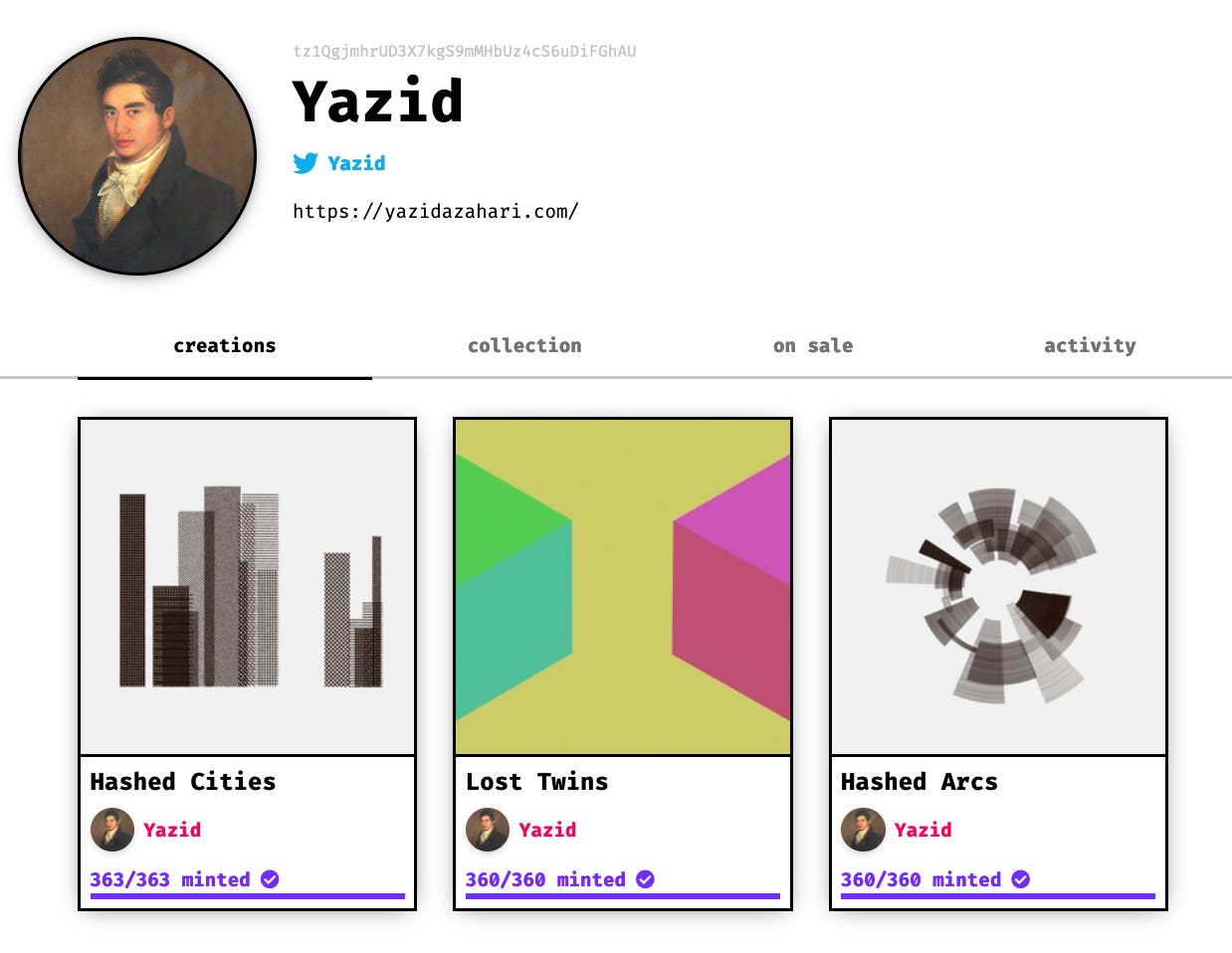

It is hard to develop a rule for how often an artist should mint. I found an excellent example from Yazid. He has minted three successful collections in one month. If you look at the time between releases, it is over one week. He hasn’t released a new collection in over two weeks, which will make his next drop highly anticipated and demanded.

A mint per day / ten collections per month would be a red flag for me.

6. How often is the artist selling out?

Selling out a collection feels like a goal archived for the artist, and it is a clear indicator of success. Look for sold-out artists, but be aware of those with open mints, as minting yourself is the best you can do (point 2). Multiple collections that are minting at the same time could be a red flag.

Artists: be aware of these and adapt your supply if your collections are not selling out.

7. Look for scarcity

No secret here. The smaller the collection is, the higher its floor will be. Pay special attention to small collections (25 to 100 pieces) from successful artists, as those will be rarer in the future.

8. Hang out on FxHash Discord server

The most passionate and active artists and collectors are pleased to support and chat on the FxHash Discord. You can spot plenty of demanded collections and artists by hanging out there.

Join FxHash Discord here.

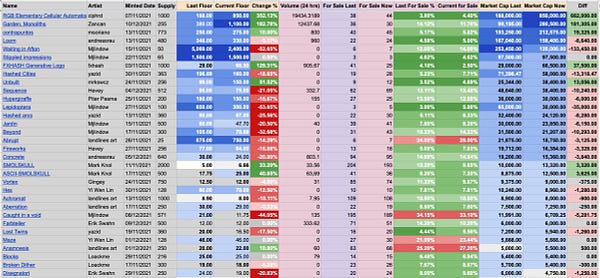

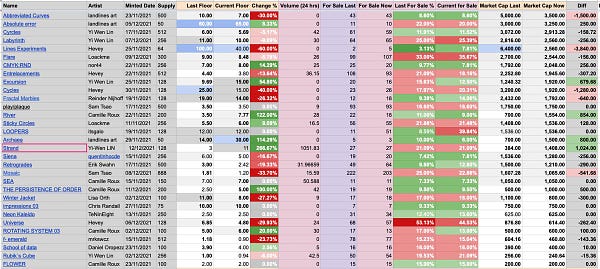

9. Monitor floor prices

The floor is the easiest and more informative metric to follow. It gives you a clear perspective of a collection’s gains or losses. Remember, it is not the only metric; you should also look for the market cap to understand the total value of a collection and the number of pieces for sale, as it shows the desire to hold or to sell from the owners.

Monitoring multiple collections can be a very tedious process. For that reason, I’m constantly compiling the floor prices among other advanced metrics and sharing them on Twitter and on my newsletter (a good reason to subscribe if you haven’t 🙃). Below you can find a tweet with my latest FxHash analysis.

In summary, FxHash is an exciting new platform, hosting brilliant collections, and it is getting the deserved attention from art lovers. There are multiple variables to track if you want to make solid investments, so it is wise to start small and slow. Increase your budget once you feel confident. Even if it sounds complex, you will understand the process with practice, and it will become easier. These rules might work right now, but you should always do your own research and improve your system as the platform evolves.

I believe we are at the right time to jump into the FxHash train. Prices aren’t very high as we are very early on the platform. FxHash is less than a month old, and it is literally on Beta.

Remember always to do your own research and spend only money you can afford to lose.

Until next time,

- Kaloh

very helpful,good guide . Thx

Great work 🍀🍾