💵 How to flip NFTs (for beginners)

Concepts you should know to make a profit selling crypto-art...

After I got lucky and earned around 25k USD in a couple of weeks, I’ve been paying more attention to the NFT market. I read, experimented, and followed the advice from professionals in the field. Trading NFTs for a profit is called “flipping”, and those doing it are called “flippers”. I believe they play an essential role and, if you are an artist or a collector, there is nothing terrible in flipping a couple of NFTs for profit from time to time.

Consider subscribing to receive my articles directly in your inbox.

My goal with this edition is to teach you the fundamentals of NFT trading. Before continuing, this is not financial advice, and you should take my suggestions at your own risk. Hopefully, you can start flipping the right way and avoid severe losses while making a decent profit (some are making life-changing money). At the end of the day, it depends on how much time you are willing to spend.

The automatic royalties are the most significant breakthrough about NFTs and one of the main reasons why this space is so exciting. Besides bringing liquidity to the market, a percentage of the sale always goes back to the artist and creators. Additionally, flippers highlight unknown projects, putting them on the map.

Not all is great about flippers. Some groups are creating fake “pumps” and hype to increase volume and value. They then sell and cash out quickly. Newcomers will buy-in when it is too late, and the “dump” will happen. These actions could be lethal because they could wipe vast bags of cash in a couple of minutes. I see this every day and got trapped a couple of times 😩.

Portfolio Structure

I virtually separate my collection into three groups—short-term flips, long-term flips, and never flip. Short-term means NFTs I’m trying to sell in less than three months; if the price is right, it could be hours. Long-term flips are NFTs that I believe have long-term potential, and I’ll flip them once their price is high enough. Never flips are pieces I’d like to hang at my place, regardless of their value. I try to make decisions to protect my never flip group.

Investment Thesis

The hardest part about flipping is finding a system and investment thesis that you like. I will share some ideas but keep in mind there isn’t a correct answer. My approach combines many factors, so I’ll try to simplify it.

The crypto network where the NFT was minted plays a significant role. Over the past months, Ethereum has been the supreme leader, accounting for most of the volume in the market. Thanks to their low gas transaction fees, its dominance is being tested by Tezos, Solana, and Cardano networks. In any case, you still encounter exponential gains in Ethereum, while that is not that common in other networks. For that reason, I suggest you start flipping in Ethereum.

The second factor is the NFT type. There are different types of collections, artists, art styles that influence the short-term and long-term value. I suggest you start to familiarize yourself with one network. Then, a couple of art styles (generative art in-chain such as Art blocks, avatars, pop art, traditional art, etc.), a couple of collections (Winter Bears, Pudgy Penguins, Tezzards, ON1 Force, etc.). After that, you could look into independent artists producing 1/1 or a small number of pieces (Michelle Thompson, Eddie Gangland, Laurence Fueller, Datzel, to name a few). Start with what you like, and once you gain more confidence, diversify.

Quick and dirty NFT analysis

Selecting what to invest in is probably the most challenging part. Multiple variables are needed to do it correctly. Everyone has a different take, and you need a unique talent to do this right. I will share three fundamental elements that have helped me a lot.

Artist or team background is probably the closest variable to identify the long-term success of a project. In the case of collections, you should look at the founding team. A team usually consists of developers, artists, and marketing/influencers in the space. You should ask yourself, what is their individual track record? Do they have a solid reputation? Are they openly sharing their identity (online identity is OK, as long as they have a history in the space)? In the case of independent artists, you can look at their artistic education, consistency over time, previous sales volume, and collaborations. You can’t fake your background, reputation, and fans.

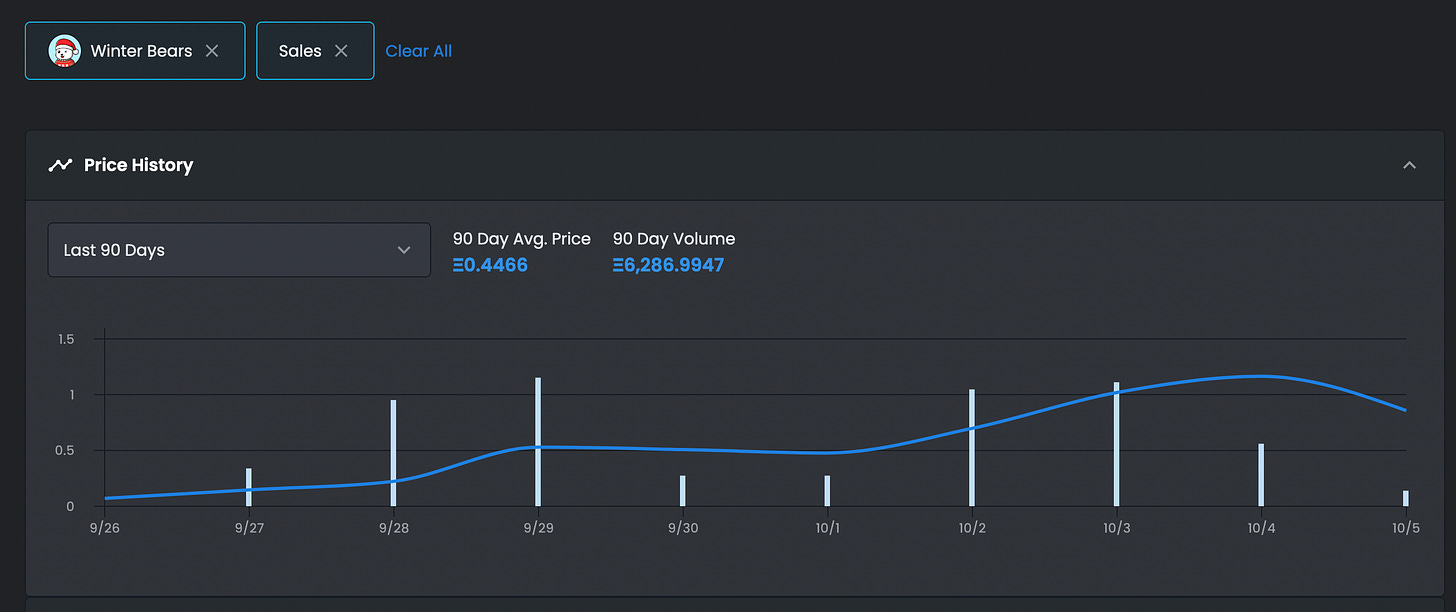

The floor is the cost of the cheapest item in a project. The floor tells you how much someone needs to spend to get in. It is also a great way to understand the current trend (up or down). The floor indicator is not magic, as it can be manipulated by buying sprees. Therefore, you could use it to feel the stability of the project (is the floor going up and down constantly, or is it stable through a couple of days/weeks?). High volatility could mean market manipulation and exponential wins or losses, while steady and stable prices could mean things are more organic but slower. Both have pros and cons; be aware of both situations.

I could write two or three more paragraphs about the floor, but we need to move on. Remember, it is easy to manipulate the floor, but it still provides tremendous informative value.

Volume is the number of transactions a specific collection or artist has over time. Low volume is related to a reduction in price, while high volume is related to liquidity. Learn this by heart liquidity is king.

The worst feeling is having an NFT that is valuable but hard to liquidate while you discover a great opportunity in the market that you can’t capitulate. The ability to sell fast whenever you need to is one of the reasons why 10k pieces collections do so well. There are five thousand people ready to buy your NFT.

First Steps

If you understood these concepts and they made sense to you, go ahead and trade some NFTs. Be careful with FOMO (fear of missing out) and FUD (fear, uncertainty, and doubt). Avoid making decisions based on them. Do not use all your capital, start with a small portion so you don’t feel too stressed.

Don’t be afraid to sell for a slight loss or, sale for a small win (this is usually correct). Oh, and take into account platform fees (usually around 2.5%) and artists’ royalties (anywhere from 1% to 30%) when setting your selling price.

Until next time,

- Kaloh

PD: Have fun, invest only money you can spare, and try to avoid checking floor prices every second (probably the most complex part 😉).

Shilling Section

Check out these cool drops from other crypto artists.