📈 How To Crunch The Numbers Behind NFTs

Understand how to use my NFT market analysis spreadsheets

Hi there!

I've been doing NFT market analysis for more than half a year now but never wrote an introduction to the metrics I use. I sporadically tweet about those indicators and their meaning, but they get lost over time. This article will teach you how to use them.

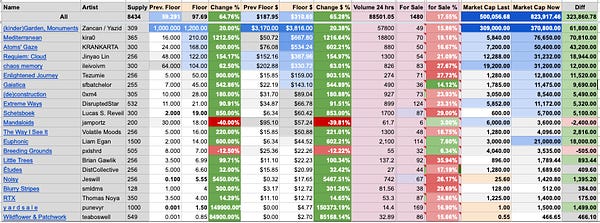

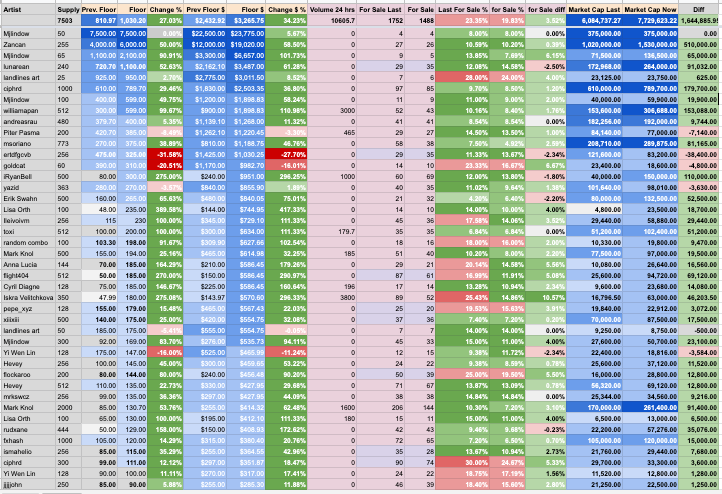

Let’s start with the spreadsheet link. I’m using the 100+ floor collections from the Tezos FxHash platform.

Floor: the floor is the lowest price available in the market for a particular NFT in a collection. This term is widely used, so you better get used to hearing it.

Why is the floor used as the main metric? here are a few reasons:

Easiest to remember over time. If you know the floor is 10 Tezos today, you could come back in a month and see it over 50 and immediately grasp the collection’s evolution. Instead, if you used other metrics like the median cost of the NFTs in a collection, the changes are not so easy to grasp.

You don’t need to understand the rarities and specific dynamics in a collection this way. By using the floor, you always know the minimum you can get (if there is liquidity, which I’ll cover later). Don’t get me wrong, taking the time to learn the rarities and dynamics in a collection makes a lot of sense, but that takes a lot of time.

The floor gives me a great way to sort collections into groups. My analyses have grown too fast as there are many exciting collections entering the game daily. Using floor-based groups lets me do this in an organized and sustainable way.

Supply: is the total number of NFTs in a collection. This value is essential to calculating the market cap but also to understanding scarcity.

Previous floor to new floor comparison: This is self-explanatory. You want to track the floor changes since the previous update.

Floor adjusted to USD: As crypto coins are very volatile, it is important to not lose perspective of the fiat value of the NFT. Many times, the floor goes down but it goes up in USD. The same can happen the opposite way, the floor could go up, but in reality, the coin went down and it is actually worth less than before.

Volume over the last 24 hours: this metric tracks the total sales volume over the past day. This helps to easily spot hot collections, but also to find new trends. Many collections might have a low volume over a period of time and suddenly get active - this indicator detects that. Additionally, the volume lets you understand liquidity.

Liquidity: Although not directly included in the spreadsheet, liquidity is related to how easy it is to sell the NFT. Sometimes we calculate the value of our NFTs using the floor, but in reality, it could take days, months, or maybe forever to sell an NFT. That is why finding and investing in liquid collections (those with a high volume of secondary sales) is critical to not end up with your capital stuck.

% of listings: this is one of my favorite metrics. It tells you the amount of NFT for sale in a collection. A high % means high numbers of collectors are looking to sell and if they can’t do it fast, they tend to lower their price (the floor will go down too). The opposite happens when there is a low % of listings, as there isn’t high availability, (the floor could rise very fast with just a couple of sales).

I use the following ratios:

Less than 5%: Outstanding.

Less than 10%: Great.

Less than 15%: Healthy.

Less than 20%: Ok.

Less than 30%: Not very healthy.

Over 30%: Worrisome, not ideal.

Change in listings %: What’s very interesting is to track down the % of listings changes. Sometimes collections might have nonhealthy numbers, but they are slowly moving in the right direction. That’s a great indicator and spotting those moves could help you enter at the right time before the floor moves up.

Market Cap: I calculate a collection’s market cap by multiplying the floor by the total supply. It helps to compare collections not only by the floor but also by the total supply.

You can use most of the metrics to get an overall feeling of the whole market. Below each of them is an average across all collections.

This will be it for today, although I have some additional metrics I would like to include in the future. Feel free to comment if you have any questions or if you have additional insights to measure NFT performance. I am always looking for new ways to evaluate NFTs.

Until next time,

- Kaloh

PD: Every week I share different market analyses, including the spreadsheet, news, and top movers. Premium subscribers get additional details, including surprises and opportunities. Consider getting a premium subscription to receive the complete recap ✌️

Nice analysis Kaloh, really enjoy your writing and thoughtful breakdowns. Great job!

deal quanlity is the most important!