📈 A New Metric To Find NFT Bargains

Introducing the Popularity To Floor Ratio (PTFR) and using it to find NFT bargains...

Over the past months, I’ve been following the FxHash marketplace closely by doing market analyses every week. Thanks to that, I’ve noticed a pattern in NFT collections suddenly rising in value. Popularity over time was a key factor.

If you are still learning about NFTs and all the basic terms I use, you should read this first How To Crunch The Numbers Behind NFTs.

How can we spot these bargains early? My thesis is simple. There are many popular collections, and those that remain popular over a long period have the potential to “explode” in price. Is there a way to see if they are undervalued compared to their popularity? I created a pair of metrics that try to answer this question.

I call it Popularity to Floor Ratio (PTFR), and it uses the volume to measure the popularity and the floor as a price measure. Some collections have way more supply than others, so I created a second flavor that factors in the supply (PTFRwS).

Popularity To Floor Ratio (PTFR) = Total Volume / Floor

Popularity To Floor Ratio with Supply (PTFRwS) = Total Volume / Total Supply / Floor

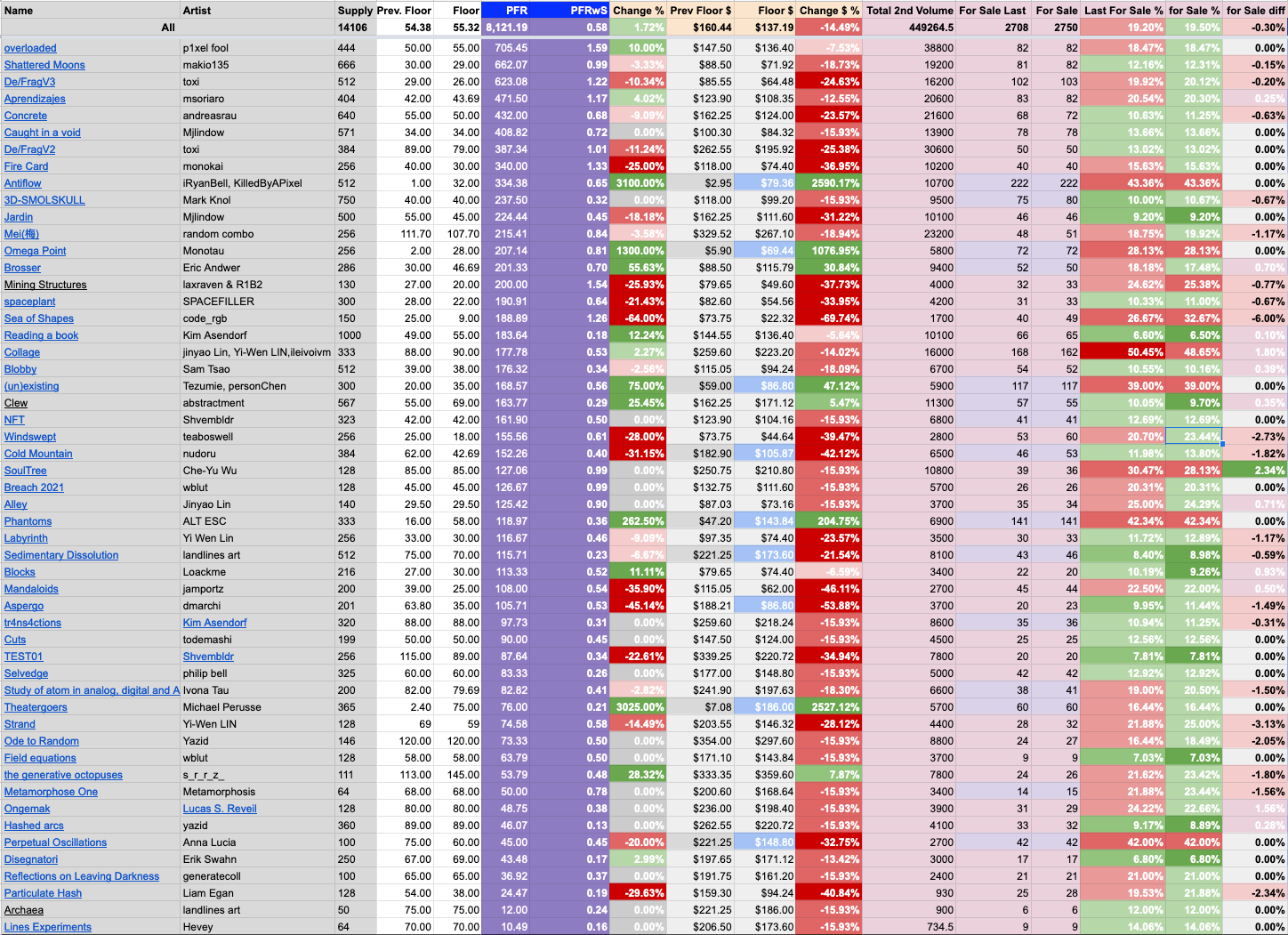

To see them in action, I took FxHash collections with floors between 25 Tezos (+/-$80) to 100 Tezos (+/-$300). I included PTFR and PTRPwS metrics in the purple columns.

For both metrics, the higher the value, the better. The following collections stand out:

Overloaded by p1xelfool (705)

De/FragV3 by toxi (623)

Aprendizajes by msoriaro (471)

Concrete by andreasrau (432)

PTFR doesn’t consider the collection size (supply); it only factors in the total volume and the floors. That is why I included PTFRwS. The following collections stand out using when looking at this metric (the scale is much lower, the avg among these collections was 0.75):

Overloaded by p1xelfool (1.59)

Fircard by Monokai (1.33)

Sea of Shapes by code_rgb (1.26)

De/FragV3 by toxi (1.22)

Aprendizajes by msoriaro (1.17)

Overload by p1xelfool, De/Frag V3 by toxi, and Aprendizajes by msoriaro made it to both groups.

Downsides

I woulnd’t follow these results blindly. There are a few reasons that could produce either high or low marks for a particular collection:

The collection was very hyped in the early days of its launch, and therefore, the trading volume was too high during those days. These metrics aim to measure the popularity of a collection over time — is it relevant and popular in the long term, or just for a few days?

I’m tracking the total volume, but it would be better to follow the volume over a certain amount of time instead. I can’t figure out how to do this yet as I can’t filter stats by time frames.

Collectors might not have discovered the collection or the artist yet, so its volume remains low.

I would use these metrics in addition to the basics I shared in How To Crunch The Numbers Behind NFTs. I’m just starting to use these formulas, so please use them cautiously. I will include them in my market analysis and make changes I see fit in the future…

Until next time,

- Kaloh

PD: As always, this isn’t financial advice. Please do your own research.

I share different market analyses every week, including the spreadsheet, news, and top movers.

Premium subscribers get additional details, including market surprises and opportunities, access to my Discord server, and NFT giveaways. Consider getting a premium subscription to receive the complete recap.

Quick quest- how do we find your subscribers Discord?

So much value.